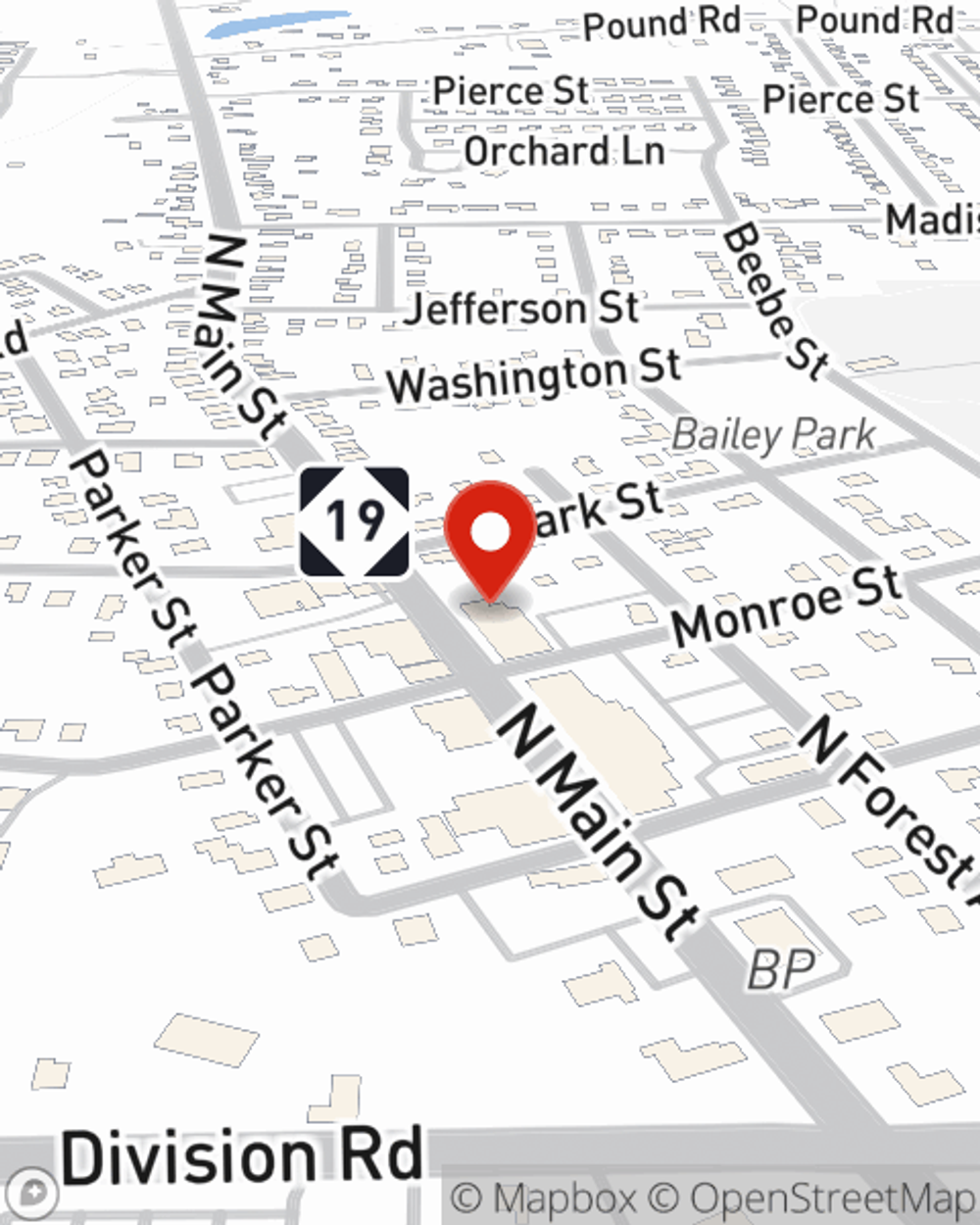

Life Insurance in and around Richmond

Protection for those you care about

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

- Macomb County

- Oakland County

- St Clair County

- Richmond

- Richmond Township

- Memphis

- Columbus

- Lenox

- Armada

- Romeo

- New Haven

- Adair

- Casco

- Riley

- Emmett

- Ray Twp

- Macomb

- Chesterfield

- Washington Twp

- Clinton Township

- Sterling Heights

- Shelby Township

- Fort Gratiot

- Port Huron

It's Never Too Soon For Life Insurance

No one likes to contemplate death. But taking the time now to arrange a life insurance policy with State Farm is a way to express love to your loved ones if death comes.

Protection for those you care about

Don't delay your search for Life insurance

Life Insurance You Can Trust

The beneficiary designated in your Life insurance policy can help cover important living expenses for your family when you pass away. The death benefit can help with things such as utility bills, college tuition or childcare costs. With State Farm, you can rely on us to be there when it's needed most, while also providing caring, responsible service.

With dependable, compassionate service, State Farm agent Michael Kerr can help you make sure you and your loved ones have coverage if something bad does happen. Call or email Michael Kerr's office today to learn more about the options that are right for you.

Have More Questions About Life Insurance?

Call Michael at (586) 789-7904 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Estate planning: Understanding the basics

Estate planning: Understanding the basics

An estate plan does more than just offer direction for assets. Estate planning can help others execute your wishes and take care of those you love.

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.

Michael Kerr

State Farm® Insurance AgentSimple Insights®

Estate planning: Understanding the basics

Estate planning: Understanding the basics

An estate plan does more than just offer direction for assets. Estate planning can help others execute your wishes and take care of those you love.

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.